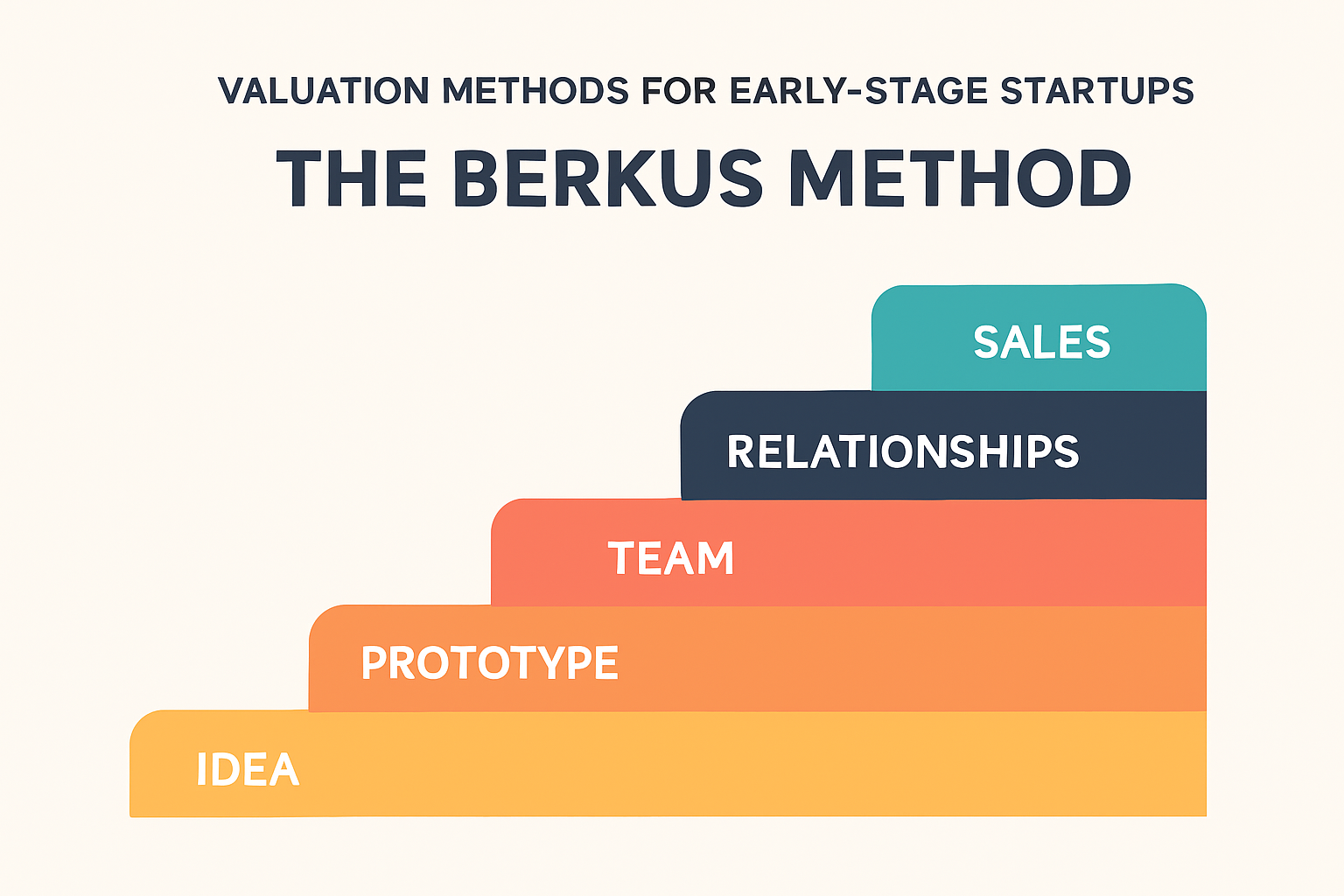

Valuation Methods for Early-Stage Startups – The Berkus Method

When startups are in their earliest stages, they often don’t have enough revenue or traction for traditional valuation approaches. That’s where the Berkus Method comes in — a simple, structured way to assign value even when numbers are thin.

Here’s how it works

1. The Idea (Up to $500K)

A strong idea or concept can already have value if it solves a big problem.

2. Prototype (Up to $500K)

A working prototype or MVP reduces risk because it shows feasibility.

3. Quality of the Team (Up to $500K)

A talented, experienced, and committed founding team is often the biggest driver of early valuation.

4. Strategic Relationships (Up to $500K)

Partnerships, advisors, or early customer commitments can significantly boost credibility.

5. Product Rollout or Sales (Up to $500K)

Actual traction — early revenue, users, or adoption — adds real weight to the valuation.

Typically, each factor can add up to $500K in value, with the total capping at around $2M–$2.5M for very early startups.

Final Thought:

The Berkus Method is all about reducing risk step by step. Each milestone proves the startup is moving closer to a sustainable business. For founders, it’s a great way to show progress. For investors, it offers a simple framework to decide how much a young startup is worth.