Government Schemes & Alternative Funding in India

Government schemes and alternative funding options have become an important lifeline for startups in India, offering much-needed capital, mentorship, and market access without relying solely on traditional venture capital or angel investment. With a growing focus on innovation and entrepreneurship, the Indian government and private ecosystem have created multiple avenues to help founders turn ideas into thriving businesses.

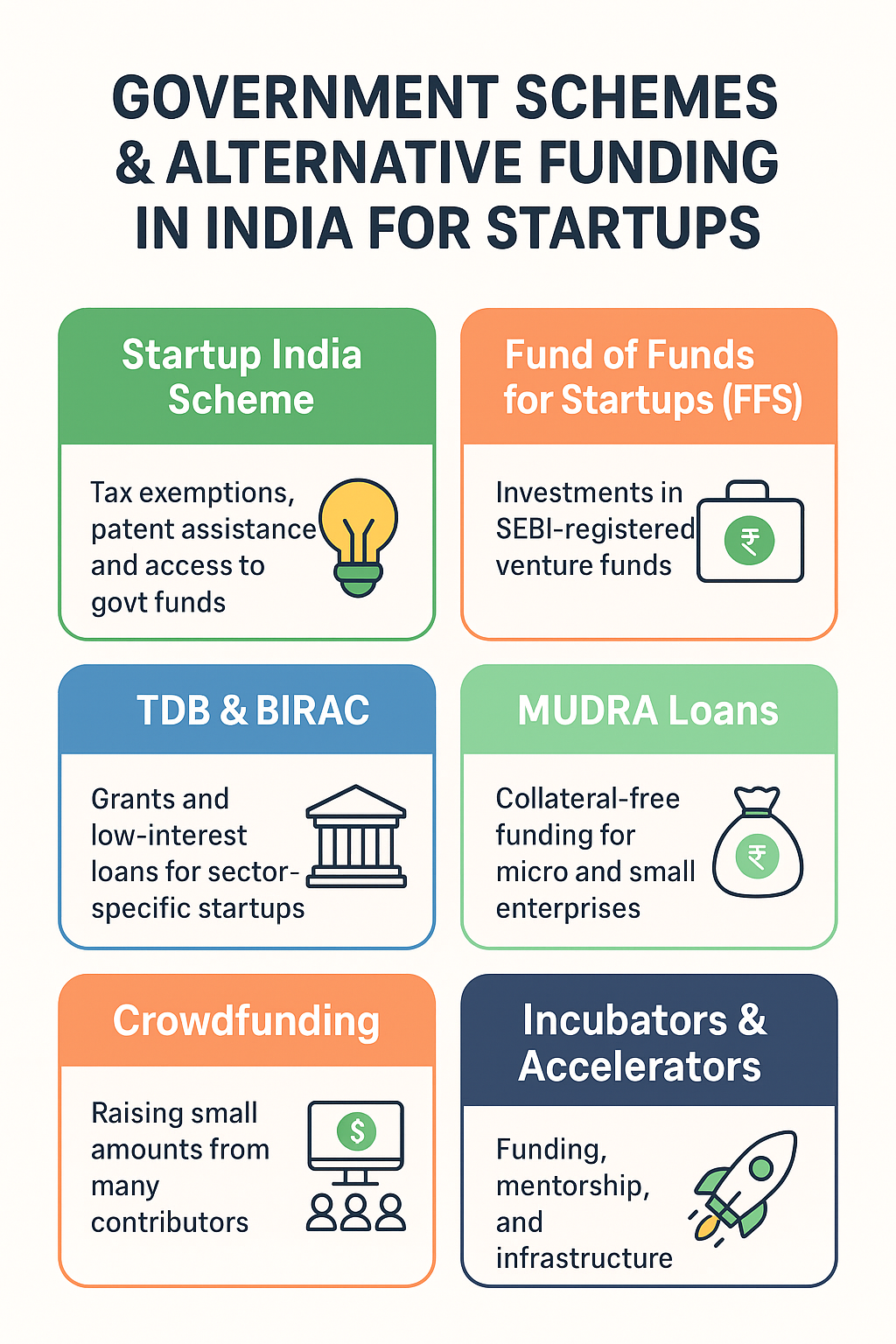

One of the most prominent initiatives is the Startup India Scheme, which provides benefits like tax exemptions for the first three years, faster patent processing, and access to government-backed funds. The Fund of Funds for Startups (FFS), managed by SIDBI, invests in SEBI-registered venture funds that support early-stage startups. For technology-driven businesses, Technology Development Board (TDB) and BIRAC (Biotechnology Industry Research Assistance Council) offer sector-specific grants and low-interest loans. Similarly, schemes like MUDRA Loans provide collateral-free financing for micro and small enterprises, making it easier for early-stage founders to access working capital.

Beyond government programs, alternative funding sources are also gaining traction. Crowdfunding platforms like Ketto and Fueladream allow startups to raise small amounts from a large number of contributors. Incubators and accelerators—such as those run by NASSCOM, CIIE.CO, and corporate-backed programs—provide a mix of funding, mentorship, and infrastructure. Additionally, impact investors focus on startups creating social and environmental change, offering funding that aligns with long-term purpose as well as profit.

The advantage of these schemes and alternative sources is that they often come with lower pressure for rapid scaling, giving founders more breathing room to experiment and refine their business models. They also open doors for entrepreneurs from non-traditional backgrounds who may not have strong investor networks.

In conclusion, India’s startup ecosystem offers a rich mix of government schemes and alternative funding options that can provide both financial support and strategic guidance. For founders, tapping into these opportunities can not only ease the fundraising process but also strengthen their foundation for long-term growth. By combining traditional investment channels with these initiatives, startups can build a more sustainable path to success.